… but not in a good way!

This article is intended for professional advisers only and is not directed at private individuals.

The Government has decided to amend the Residence Nil-Rate Amount (RNRA) downsizing provisions in the Inheritance Tax Act to correct the drafting issue that I discovered last year. The amendments are included s65 of the latest Finance (No3) Bill published on 7th November 2018. The changes will make s8FE(9) of IHTA work in line with HMRC’s original understanding of the intent of the provisions as reflected in their guidance and case studies.

The issue may arise in the following circumstances:

- A couple have “downsized” during their lifetime

- There is a lower value residential property (QRI) in their estates

- The RNRA (enhanced by the downsizing addition) is not fully used in the estate of the first to die and the unused amount is expected to transfer to the second estate

In these circumstances the provisions were intended that the tax situation would be less generous than where the RNRA was used to its full extent on first death – i.e. more capital was closely inherited rather than left to the surviving spouse or civil partner.

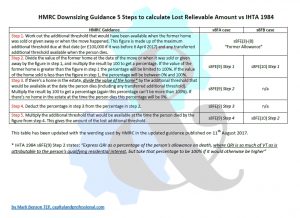

Once the amendment is in force the calculation of the “lost relievable amount” in s8FE(9) will take into account the whole value of the Qualifying Residential Interest (QRI) comprised within the estate (E) rather than just the part contained within the chargeable estate (VT).

The Bill indicates that the changes are to take effect for estates where the individual dies “after 29th October 2018”. This date is important as it means that the estates of those who died between the introduction of the RNRA on 6th April 2017 and that date should be calculated in line with the original drafting of the statute which is (accidentally it transpires) more generous to the tax payer as shown in my article “Dodging Downsizing Downfall”.

The discrepancy between the two methods is baked into the calculations for the estate of the first to die, setting the percentage of RNRA that is carried forward under the transferability provisions. The calculation in the second estate is unaffected by the change as it simply uses the percentage brought forward.

It is therefore important to ensure that the calculation of IHT for first deaths between 6th April 2017 and 29th October 2018 (or the eventual effective date if changed) has been made in line with the original statute and not following the intended method that will only be effective after the new provisions come into force. At present it is unclear what method HMRC have been using since 6th April 2017 and I would be keen to learn of any cases that meet the criteria and offer to check the calculation for practitioners.

————-

Owner & Director

By Mark Benson TEP

Owner & Director

Capital & Professional Consulting Limited

Please contact me if you think you have a case that is affected by this issue and would like assistance in assessing the impact on your clients.