This article is intended for professional advisers only and is not directed at private individuals.

A case study on downsizing and transferability

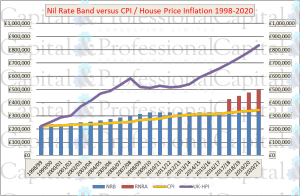

Before the introduction of the transferable nil-rate band (NRB) in 2007 it was necessary to make provision in the will to avoid losing the benefit of one of the two NRBs that should be available to a married couple. If, as would typically be the preference, the whole of the estate of the first to die was left to the surviving spouse as an exempt transfer, the first NRB would not be used and would be permanently lost. The solution was to leave an amount equal to the NRB on first death as a chargeable transfer, often to a discretionary trust to maximise control and flexibility. Following a change of legislation, for deaths on or after 9th October 2007 any unused NRB became available to transfer to the estate of the surviving spouse. In principle, this made the will planning redundant, at least purely from a tax efficiency perspective.

Since 6th April 2017 an additional “Residence Nil-Rate Amount” (RNRA) has been available, subject to complicated qualification criteria. The RNRA is also generally transferable in the same way as the standard NRB. However, where some or all of the RNRA is secured with respect to a “downsizing event” – where a property has been disposed of in lifetime at a higher value than that of any property in the estate at death – the amount transferred will not be as generous as might be expected.

To illustrate this, I present a case study based upon a real situation that is being handled by a solicitor client of Capital & Professional. Names, dates and amounts have been changed for reasons of privacy, but the tax outcome and potential savings are representative of the case.

Harry & Sandra

In their late 80s, Harry and Sandra were both becoming frail and decided that they would be better off spending their last few years in a residential home together. They found a suitable home and moved in during 2017 putting their family home on the market. The family home, which was jointly owned, was eventually sold in September 2017 for £320,000.

Sadly, their health continued to decline, and Harry passed away in January 2018 followed by Sandra in November of that year. They had executed wills in 2010 leaving everything to the survivor on first death and everything in equal shares to their sons and daughters upon second death. Harry’s estate, made up of cash and investments, was valued at £435,000 at death and Sandra’s estate was valued at £1,130,000 made up again of cash and investments plus the interest in Harry’s estate which was still in administration at that time. Neither had made any lifetime transfers.

IHT calculations

Although neither owned a residential property interest on death, the standard NRB available to each estate can be augmented by a RNRA derived from the sale of the family home, which occurred after the qualifying date for a downsizing addition (8th July 2015). Since the value of the interest sold – £160,000 each – is greater than the Residential Enhancements available and since neither estate exceeds the taper threshold of £2m, it would be anticipated that both estates would qualify for the maximum RNRA – £100,000 for Harry in 2017/18 and £125,000 for Sandra in 2018/19.

Harry’s estate – first death, January 2018

The IHT situation for Harry’s estate is very simple since everything was left to Sandra as an exempt transfer. Consequently, there is no tax to pay and 100% of the NRB and RNRA are available to carry forward. The IHT calculation looks like this:

| Estate at Death “E” | £435,000 |

| Less Exempt to spouse | -£435,000 |

| Equals Chargeable Transfer “VT” | £0 |

| Less RNRA used | £0 |

| Less NRBs used | £0 |

| Equals VT over nil rate bands | £0 |

| Rate of IHT | 40.00% |

| Total IHT charge generated upon death | £0 |

Sandra’s estate – second death, November 2018

Sandra’s estate passes as a chargeable transfer to the children in equal shares. As 100% NRB is carried forward from Harry’s estate a double band of £650,000 is available. One might anticipate that the same would apply to the RNRA with here estate enjoying £250,000 in additional nil-rate provision. However, the downsizing calculation is rather complicated and is designed to reduce the benefit obtained from the transferred RNRA from Harry’s estate. Let’s look at the calculation in detail:

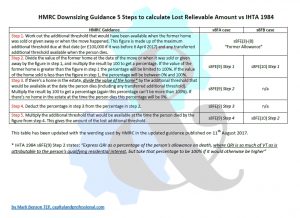

In this case, as there was no residential interest in the estate at death, the RNRA calculation falls under s8FB of the Inheritance Act 1984 (IHTA). The available RNRA will be wholly comprised of the “downsizing addition”. All subsequent section references are also from the IHTA. The first step in calculating the downsizing calculation is to work out the “former allowance” by following the procedure in s8FE(3). The table below shows the wording of that section, the figures from Sandra’s estate and notes on the effect of each step:

| (3)In this section, the person’s “former allowance” is the total of— | Sandra’s estate | Notes |

| (a)the residential enhancement at the time of completion of the disposal of the qualifying former residential interest, | £100,000 | Value for the tax year as at the sale of the property, September 2017 |

| (b)any brought-forward allowance that the person would have had if the person had died at that time, having regard to the circumstances of the person at that time (see section 8G as applied by subsection (4)), and | £100,000 | 100% brought forward from Harry’s estate |

| (c)if the person’s allowance on death includes an amount of brought-forward allowance which is greater than the amount of brought-forward allowance given by paragraph (b), the difference between those two amounts. | £25,000 | 100% brought forward allowance as at November 2018 is worth £125,000 |

| Total | £225,000 | The “former allowance” |

Next we follow the steps in s8FE(10):

| (10)Where, as a result of section 8FB, there is entitlement to a downsizing addition in calculating the person’s residence nil-rate amount, take the following steps to calculate the person’s lost relievable amount. | Sandra’s estate | Notes |

| Step 1 Express the value of the person’s qualifying former residential interest as a percentage of the person’s former allowance, but take that percentage to be 100% if it would otherwise be higher. |

£160,000 / £225,000 x 100 = 71.11% |

The QFRI is the value of Sandra’s share of the disposal proceeds, so half of the £320,000 sale price of the property |

| Step 2 Calculate that percentage of the person’s allowance on death. The result is the person’s lost relievable amount. |

£250,000 x 71.11% = £177,778 |

The allowance on death is the £125,000 applying as at November 2018 plus 100% uplift carried forward from Harry’s estate |

Finally, this figure is tested for tapering, which as we know does not affect this case, and applied to the estate as the “downsizing addition” and ultimately the RNRA. The final IHT calculation then looks like this:

| Estate at Death “E” | £1,130,000 |

| Less exempt transfer to spouse | £0 |

| Equals Chargeable Transfer “VT” | £1,130,000 |

| Less RNRA used | -£177,778 |

| Less NRBs used | -£650,000 |

| Equals VT excess over nil rate bands | £302,222 |

| Rate of IHT | 40.00% |

| Total IHT charge generated upon death | £120,889 |

What’s happened to the rest of it?

Whereas we anticipated enjoying the benefit of two full residential enhancements worth £250,000, in fact the calculation only yields 71.11% of that figure, resulting in a higher IHT charge. Why has Sandra’s estate not benefited from 100% transfer of Harry’s RNRA?

The answer is buried in s8FA and s8FB of the statute where the qualifying conditions for the downsizing addition are given. One of the conditions in each case is that part of the remainder of the estate – i.e. not a residential property interest – is “closely inherited”, broadly meaning that it passes to children, grandchildren etc. It is perhaps not obvious but as a consequence if the remainder passes to the surviving spouse it is not closely inherited, and the strict conditions to qualify for the downsizing addition are not met. We can see from the calculations that in practise this means that the value of any brought forward RNRA is restricted to some lower value than if it had been used on first death. The exact percentage reduction depends on the split of ownership of the QFRI.

What can they do?

Harry and Sandra’s solicitor identified the problem at the end of 2018, and since both deaths have occurred within the last two years the option is open to effect a deed of variation to change the distribution of Harry’s estate. The full benefit of the RNRA can be recovered simply by redirecting that an amount equal to the available residential enhancement is closely inherited by his children with the remainder passing to spouse as before.

Harry’s estate – first death, January 2018 – after variation

The variation is made redirecting £100,000 to Harry’s children and the remainder to Sandra. The IHT account for Harry’s estate is resubmitted and now looks like this::

| Estate at Death “E” | £435,000 |

| Less Exempt to spouse | -£335,000 |

| Equals Chargeable Transfer “VT” | £100,000 |

| Less RNRA used | -£100,000 |

| Less NRBs used | £0 |

| Equals VT over nil rate bands | £0 |

| Rate of IHT | 40.00% |

| Total IHT charge generated upon death | £0 |

Sandra’s estate – second death, November 2018 – recalculated

The IHT account for Sandra’s estate is then resubmitted:

Revised Former Allowance calculation

| (3)In this section, the person’s “former allowance” is the total of— | Sandra’s estate | Notes |

| (a)the residential enhancement at the time of completion of the disposal of the qualifying former residential interest, | £100,000 | Value for the tax year as at the sale of the property, September 2017 |

| (b)any brought-forward allowance that the person would have had if the person had died at that time, having regard to the circumstances of the person at that time (see section 8G as applied by subsection (4)), and | £NIL | Harry’s estate has now used all of the available RNRA |

| (c)if the person’s allowance on death includes an amount of brought-forward allowance which is greater than the amount of brought-forward allowance given by paragraph (b), the difference between those two amounts. | £NIL | There is no brought-forward allowance |

| Total | £100,000 | The “former allowance” |

Next we follow the steps in s8FE(10):

| (10)Where, as a result of section 8FB, there is entitlement to a downsizing addition in calculating the person’s residence nil-rate amount, take the following steps to calculate the person’s lost relievable amount. | Sandra’s estate | Notes |

| Step 1 Express the value of the person’s qualifying former residential interest as a percentage of the person’s former allowance, but take that percentage to be 100% if it would otherwise be higher. |

£160,000 / £100,000 x 100 = 100% |

With the lower former allowance this step now returns the maximum 100% |

| Step 2 Calculate that percentage of the person’s allowance on death. The result is the person’s lost relievable amount. |

£125,000 x 100% = £125,000 |

This time only a single allowance on death of £125,000 is available, but we secure 100% of it |

As before there is no tapering and this figure becomes the downsizing addition and therefore RNRA for Sandra’s estate. The final revised IHT calculation is therefore:

| Estate at Death “E” | £1,030,000 |

| Less exempt transfer to spouse | £0 |

| Equals Chargeable Transfer “VT” | £1,030,000 |

| Less RNRA used | -£125,000 |

| Less NRBs used | -£650,000 |

| Equals VT excess over nil rate bands | £255,000 |

| Rate of IHT | 40.00% |

| Total IHT charge generated upon death | £102,000 |

The final IHT liability is reduced from £120,889 to £102,000 a saving of £18,889!

Planning points

Harry and Sandra’s family were fortunate that their alert solicitor spotted that some of the anticipated RNRA had been lost. A simple deed of variation was able to secure a tax saving of nearly £20,000. However, this option was available merely by the chance proximity of the two deaths.

The deed of variation remedy will not be available in many cases, since the variation needs to be made to the estate of the first to die, but the tax issue affects the estate of the second and may only come to light at that time – often more than two years later.

For most people it will be necessary to make amendments to the wills as soon as a downsizing event takes place to ensure that sufficient capital will be closely inherited on first death to secure the maximum RNRA.

Nil-rate will planning is back on the agenda.